BTC Price Prediction: $122K Resistance Test Likely as Bullish Fundamentals Face Regulatory Headwinds

#BTC

- Technical Strength: Price above key moving averages suggests bullish trend intact

- Regulatory Overhang: US Treasury policy creates near-term uncertainty

- Institutional Interest: Ark Invest's move signals growing professional adoption

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

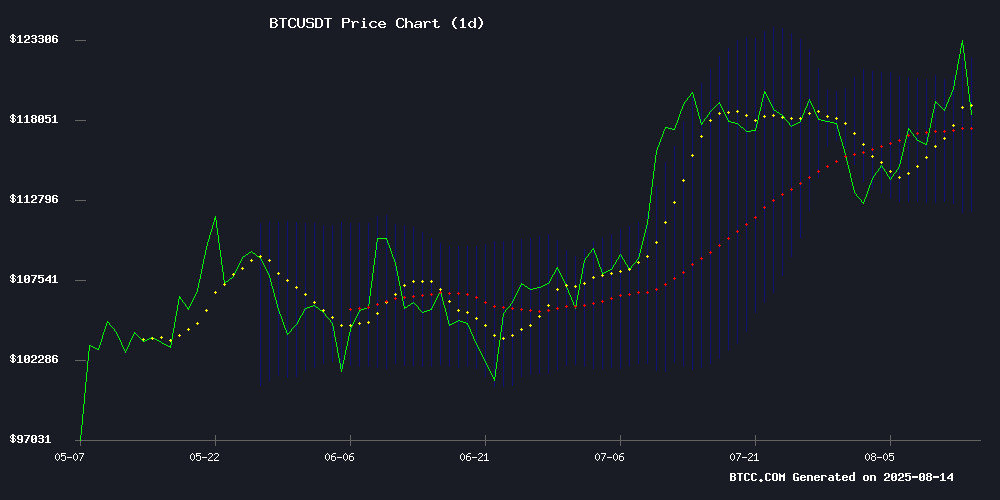

BTC is currently trading at $118,401, above its 20-day moving average of $117,080, indicating a bullish trend. The MACD shows a bearish crossover with the signal line above the MACD line, suggesting potential short-term consolidation. However, the price remains within the Bollinger Bands, with the upper band at $122,150 acting as resistance and the lower band at $112,011 providing support. According to BTCC financial analyst Robert, 'The technical setup suggests BTC could test the $122,150 resistance level if buying pressure increases.'

Market Sentiment Mixed as Regulatory News Offsets Positive Developments

Recent headlines show a tug-of-war between bullish and bearish catalysts. Jack Dorsey's Block unveiling modular Bitcoin mining rigs and El Salvador's Bitcoin windfall are positive, but the U.S. Treasury's rejection of Bitcoin purchases and strategic reserve policy shift have created headwinds. 'The market is digesting conflicting signals,' says BTCC's Robert. 'While institutional interest grows with Ark Invest's $170M stake, regulatory uncertainty is capping upside potential near the $123K resistance level.'

Factors Influencing BTC's Price

Jack Dorsey's Block Unveils Modular Bitcoin Mining Rigs with Upgradable Components

Block, the fintech company led by Bitcoin advocate Jack Dorsey, has introduced a groundbreaking modular mining rig designed to extend hardware lifespan and reduce operational costs. The Proto Rig features swappable components like hashboards, enabling incremental upgrades without full system replacements—a departure from the industry's traditional three-to-five-year replacement cycle.

Thomas Templeton, Block's hardware lead, criticized conventional miners as 'hard to repair, expensive to upgrade, and inefficient in power utilization.' The new system aims to cut costs by 15-20% per upgrade cycle while promoting hardware decentralization. This innovation arrives as Bitcoin mining faces increasing scrutiny over energy consumption and equipment sustainability.

Bitcoin Dips Below $119K Following U.S. Treasury's Strategic Reserve Policy Shift

Bitcoin's rally stalled abruptly as prices fell below $119,000 after U.S. Treasury Secretary Scott Bessent confirmed the cessation of BTC purchases for government reserves. The cryptocurrency had earlier touched a record $124,457 before the policy announcement triggered a 4% retreat.

Market analysts highlight the symbolic weight of this decision, noting that while no immediate sell-off occurred, the move casts doubt on institutional adoption trajectories. The Treasury's prior accumulation strategy had been viewed as a bullish signal for crypto asset legitimacy.

TradingView charts show increased volatility around the $120,000 support level, with the BTC/USDT pair testing key technical thresholds. The development underscores how macroeconomic policy decisions now directly impact digital asset valuations.

U.S. Government Rejects Bitcoin Purchases, BTC Price Reacts

Treasury Secretary Scott Bessent has quashed speculation about U.S. government Bitcoin acquisitions, confirming the Treasury will only replenish its BTC reserves through seized assets. The announcement triggered an immediate market reaction, with Bitcoin sliding below $119,000.

The decision marks a strategic departure from proposals championed by crypto advocates like Senator Cynthia Lummis and MicroStrategy's Michael Saylor. Instead of building reserves akin to gold holdings, the administration will focus on deficit reduction through traditional tax revenues.

Market participants had anticipated potential institutional adoption following months of speculation. The rejection underscores the administration's cautious stance toward cryptocurrency as a reserve asset, despite growing global competition in digital asset adoption.

Ark Invest Acquires $170M Stake in Bullish on NYSE Debut as Crypto Stocks Show Volatility

Ark Invest seized a $170 million position in Bullish (BLSH) during the crypto platform's explosive NYSE debut, purchasing 2.5 million shares across three ETFs. Bullish shares surged 84% from their $37 IPO price to close at $68, peaking at $102 intraday. The rally extended into Thursday with a 15% gain, defying a broader crypto market pullback that erased part of bitcoin's recent record high at $124,000.

Cathie Wood's firm continues its pattern of aggressive early bets on crypto equities, having previously taken a $373 million position in Circle's June IPO now worth $675 million. The move comes as other newly listed crypto stocks like eToro and Circle declined 2-3%, highlighting the sector's selective volatility amid institutional adoption.

U.S. Treasury Rejects Bitcoin Purchases, Opts for Seizures to Grow Reserves

U.S. Treasury Secretary Scott Bessent has dashed hopes of federal Bitcoin acquisitions, stating unequivocally that the government will not purchase additional BTC. The announcement reverses months of speculation fueled by White House officials who had hinted at aggressive cryptocurrency accumulation.

Instead, the Treasury will rely solely on law enforcement seizures to expand its Bitcoin reserves. Bessent confirmed plans to retain confiscated assets rather than liquidating them, marking a strategic shift in the government's approach to cryptocurrency holdings.

The decision comes despite earlier executive actions by the Trump administration to establish a strategic Bitcoin reserve. Market observers note this development removes a potential source of institutional demand for BTC, while cementing the government's role as an involuntary accumulator of cryptocurrency through enforcement actions.

Bitcoin’s Push Toward $123K Meets Resistance: Trend Shift or Temporary Pullback?

Bitcoin’s climb toward the $123,000 mark is drawing intense market attention as the cryptocurrency faces a significant resistance level that could determine its short-term trajectory. Prices are consolidating after steady gains, leaving traders to debate whether this pause signals a temporary pullback or the start of a more prolonged trend shift.

Select altcoins are showing promising setups, offering potential opportunities for growth. Bitcoin’s current trading range between $116K and $122K reflects a 3.5% weekly rise and a 21% gain over the past six months. A breakout above $123K could propel it toward $129K, marking a 7% increase from current levels.

Market indicators remain bullish, but the resistance zone will test Bitcoin’s momentum. The outcome could set the tone for broader crypto market sentiment in the coming weeks.

Altcoins Face ‘Rektember’ Risk – Will History Repeat or Surprise?

September looms as a perilous month for cryptocurrencies, historically dubbed 'Rektember' for its tendency to trigger market downturns. While Bitcoin has closed negative in eight of the past twelve Septembers, averaging a 3.77% decline, altcoins often bear the brunt due to their heightened volatility and thinner liquidity.

Market watchers are divided on whether 2025 will follow this pattern. Coin Bureau's Dan points to unique macroeconomic factors—including potential Federal Reserve rate cuts—that could disrupt the seasonal trend. Yet early weakness in altcoins, contrasted with Bitcoin's range-bound trading, keeps traders wary.

The crypto landscape has evolved since past cycles, with institutional participation and derivative markets altering traditional dynamics. Whether this September brings capitulation or defiance of history hinges on how these modern variables interact with seasonal pressures.

US Treasury: No Plans to Buy Bitcoin, Says Secretary Bessent

US Treasury Secretary Bessent has quashed speculation about potential government investment in Bitcoin, stating unequivocally that no such plans exist. The remarks come amid growing institutional interest in digital assets, with policymakers prioritizing regulatory frameworks over direct exposure.

Market observers note the announcement reinforces a measured approach to cryptocurrency adoption at the federal level. While recognizing blockchain's transformative potential, the Treasury appears focused on establishing guardrails rather than becoming a market participant.

Strategy and El Salvador Reap Massive Bitcoin Windfall as BTC Hits Record High

Strategy, the rebranded entity formerly known as MicroStrategy, and the nation of El Salvador are celebrating monumental paper gains from their Bitcoin holdings as the cryptocurrency surged to an unprecedented all-time high exceeding $124,000. The milestone underscores the transformative power of early institutional adoption in digital asset markets.

Strategy's BTC treasury has ballooned to a historic valuation of $77.2 billion, nearly doubling its 2024 position. The firm's 628,946 BTC stash—acquired at an average price of $73,301 per coin—now represents a staggering $30 billion in unrealized profits. Chairman Michael Saylor's controversial accumulation strategy, once derided by traditional finance skeptics, has positioned the company among the world's most valuable asset holders.

El Salvador's national Bitcoin reserves have similarly benefited from the rally. The Central American nation's pioneering adoption of BTC as legal tender in 2021 continues to yield dividends, though specific gain calculations remain undisclosed. Both entities demonstrate how conviction in Bitcoin's long-term value proposition can overcome short-term volatility concerns.

How High Will BTC Price Go?

Based on current technicals and market sentiment, BTC has a strong chance of testing the $122,150 resistance level in the near term. Key factors to watch:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $118,401 | Trading above 20-day MA |

| Bollinger Upper Band | $122,150 | Immediate resistance |

| MACD | Bearish crossover | Short-term consolidation likely |

BTCC's Robert notes: 'The $123K level remains psychologically important. A breakout could trigger FOMO buying, but regulatory news flow will determine sustainability.'